We face risks in all phases of life but do we invest enough time in managing those risks? In the dynamic landscape of finance, risk is an inevitable companion on the journey to financial success.

Whether you’re an individual investor, a business owner, or a financial professional, understanding and effectively managing risk is paramount to growth. This publication will delve into the principles of risk management, its significance across various domains, and practical strategies for mitigating potential threats.

ABOUT RISK MANAGEMENT

At its core, risk management is the process of identifying, assessing, and controlling potential threats that could impact the achievement of objectives. These threats could manifest as market fluctuations, economic downturns, or unforeseen events in the financial world. Successful risk management involves not only minimizing potential negative impacts but also optimizing opportunities.

FINANCIAL RISK

Financial risk is the possibility of losing money on an investment or business venture. Some more common and distinct financial risks include market risk, credit risk, operational risk, and liquidity risk.

Market Risk: Market risk is associated with the volatility of financial markets. It includes the potential for losses due to fluctuations in interest rates, exchange rates, and commodity prices. Diversification, hedging, and thorough market analysis are common strategies to address market risk.

Credit Risk: Credit risk arises when a borrower fails to meet their financial obligations. This can affect both individual investors and institutions. Rigorous credit assessments, monitoring credit ratings, and diversifying credit exposures are key components of managing credit risk.

Operational Risk: Operational risk encompasses the potential for losses due to internal processes, systems, or human error. Robust internal controls, employee training, and contingency planning are crucial to mitigate operational risks.

Liquidity Risk: Liquidity risk arises when an entity cannot meet its short-term financial obligations. Maintaining a balanced and diversified portfolio, as well as having access to emergency liquidity sources, helps manage liquidity risk effectively.

THE RISK MANAGEMENT PROCESS

Risk management is a system of people, processes, and technology that enables an organization to establish objectives in line with values and risks. Four important steps of the risk management process are risk identification, risk analysis & assessment, control & mitigation, and monitoring & review.

Risk Identification: The first step in risk management is identifying potential risks. This involves a comprehensive analysis of internal and external factors that could impact objectives. Stakeholder input, historical data, and scenario analysis play vital roles in this phase.

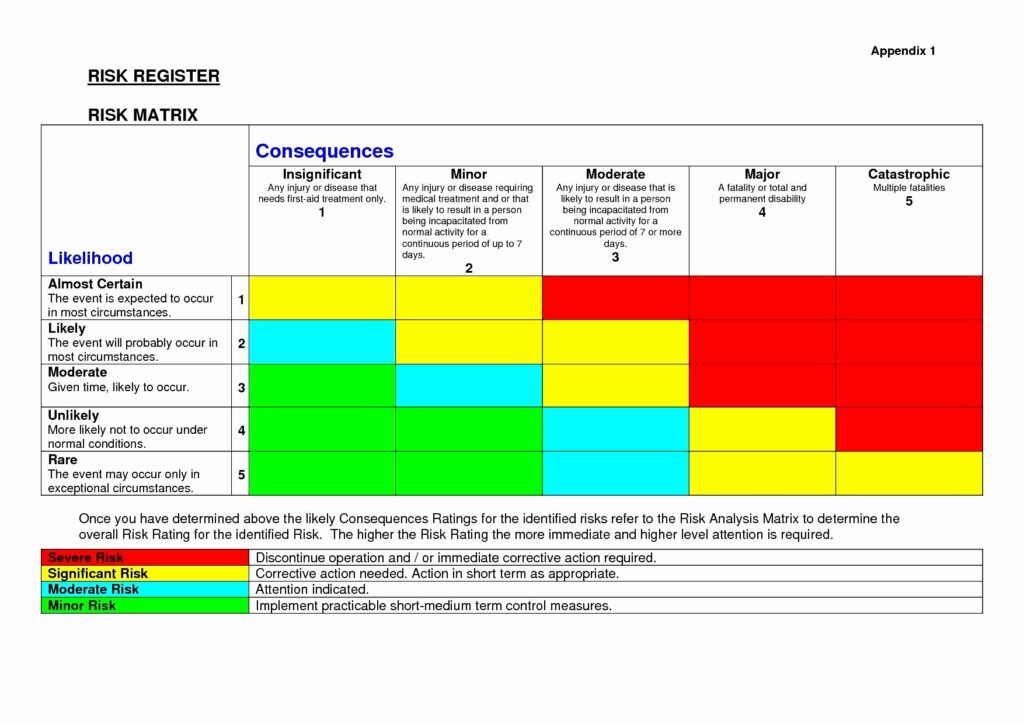

Risk Analysis and Assessment: Once risks are identified, the next step is assessing their potential impact and likelihood of occurrence. Quantitative and qualitative methods, risk matrices, and statistical models are employed to gauge the severity of each risk.

Control and Mitigation: After assessing risks, effective control measures and mitigation strategies are implemented. These can include implementing safety nets, creating contingency plans, and optimizing financial structures to minimize potential negative impacts.

Monitoring and Review: Risk management is an ongoing process that requires continuous monitoring and review. Regularly reassessing risks, adjusting strategies as needed, and staying abreast of changing market conditions is critical to maintaining an effective risk management framework.

RISK MANAGEMENT IN INVESTMENT STRATEGIES

Strategic Asset Allocation: One of the fundamental principles in investment risk management is strategic asset allocation. This involves diversifying investments across different asset classes, such as stocks, bonds, and real estate, to spread risk and optimize returns. A well-balanced portfolio can weather market volatility more effectively.

Diversification: Diversification is a key strategy to mitigate risk in an investment portfolio. By spreading investments across different industries, regions, and types of assets, investors can reduce the impact of a poor-performing investment on the overall portfolio. Diversification is a cornerstone of risk management.

Hedging: Hedging is a technique where investors use financial instruments, such as options or futures, to offset potential losses in their portfolio. While it doesn’t eliminate risk, it can act as a safeguard against adverse market movements.

RISK MANAGEMENT IN BUSINESS OPERATIONS

Contingency Planning: In the business world, unexpected events can disrupt operations. Contingency planning involves identifying potential risks and developing strategies to respond to and recover from these events. This proactive approach can minimize downtime and financial losses.

Insurance: Insurance is a classic tool for managing risk in business. Whether it’s property insurance, liability coverage, or business interruption insurance, having the right policies in place can provide financial protection in the face of unforeseen events.

Supply Chain Management: Globalization has increased interconnectivity in supply chains, making businesses more susceptible to disruptions. Effective supply chain management involves diversifying suppliers, having contingency plans, and monitoring geopolitical and economic factors that could impact the supply chain.

BEHAVIORAL ASPECTS OF RISK MANAGEMENT

While risk management often involves quantitative analysis and strategic planning, understanding the behavioral aspects is equally important. Human psychology, decision-making biases, and risk perception can significantly influence how risks are managed. Awareness of these factors can enhance the effectiveness of risk management strategies.

EMERGING TRENDS IN RISK MANAGEMENT

Technology Integration: Advancements in technology, including artificial intelligence and machine learning, are transforming risk management. Automated risk assessment tools, predictive analytics, and real-time monitoring systems enable quicker and more accurate identification and response to potential risks.

Environmental, Social, and Governance (ESG) Factors: There is a growing recognition of the impact of environmental, social, and governance factors on business and investment risks. Companies and investors increasingly incorporate ESG considerations into their risk management frameworks to address long-term sustainability and societal impacts.

FINAL THOUGHTS

In the complex world of finance and business, risk management is not merely a protective measure but a strategic imperative. Individuals and organizations can navigate uncertainties and capitalize on opportunities by adopting a proactive and comprehensive approach to identifying, assessing, and mitigating risks. Embrace risk management as a dynamic and ongoing process, and you’ll be better positioned to safeguard your investments, achieve your objectives, and thrive in an ever-changing financial landscape.

Sources

Fraser, J. and Simkins, B.J. 2010. Enterprise Risk Management: Today’s Leading Research and Best Practices for Tomorrow’s Executives. John Willey & Sons. Inc.

Mc Kinsey & Company. 2017. The future of risk management in the digital era. Report. Accessed December 27, 2023.

Shooters Journal. Financial Risk Assessment Matrix Template. Accessed December 27, 2023.

Thomson Reuters. 2021. ESG Trends in Risk Management. Article. Accessed December 27, 2023.