Project Agorá, led by the Bank for International Settlements (BIS), aims to modernize cross-border payments by creating a multi-currency unified ledger.

Launched in 2023, Project Agorá brings together seven central banks and over 40 private firms to explore how tokenization and smart contracts can make transactions quicker, more transparent, and cost-effective.

Sounds interesting right?

This article covers Project Agorá’s goals, anticipated impacts on global payments, and the challenges it faces in balancing centralization with the rise of decentralized finance.

ABOUT PROJECT AGORÁ

Project Agorá, distinct from the similarly named Agora project (Project N: 2022-1-FR01-KA220-ADU-000086999), which is co-funded by the European Union, is an initiative led by the Bank for International Settlements (BIS). Established in 1930, the Bank’s capital is held by central banks only.

63 central banks and monetary authorities are currently members of the BIS and have rights to voting and representation at General Meetings. These banks represent countries from around the world that together account for about 95% of world GDP. Its head office is in Basel, Switzerland and it has two representative offices: in Hong Kong SAR and Mexico, as well as Innovation Hub Centres around the world.

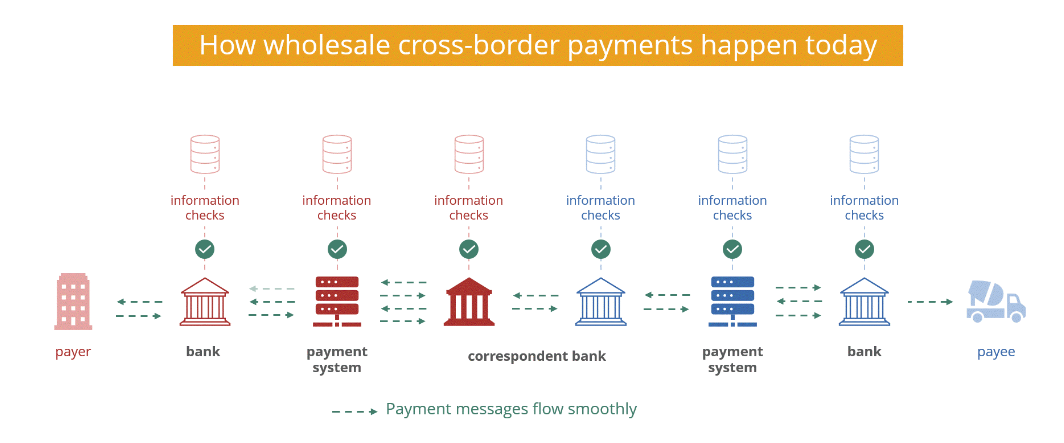

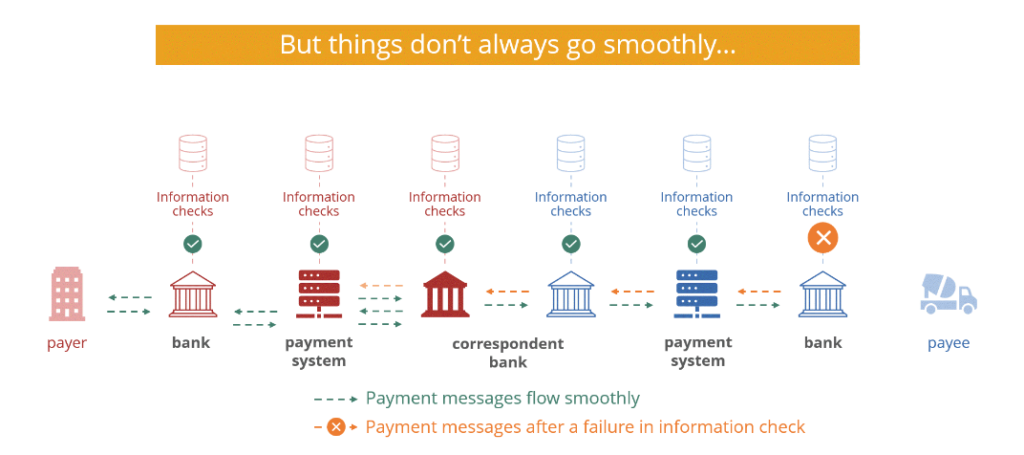

For individuals and businesses working in or with island nations such, navigating correspondent banking for international payments can be a significant challenge, particularly for remote workers and digital nomads. The process often involves extensive initial information requirements and delays as payments undergo due diligence, making it inefficient, time-consuming, and costly.

This is especially frustrating when you’re waiting for payment for services rendered and discover that not only has your local bank deducted its fees, but the correspondent bank and sometimes even the sender’s bank have also taken their share from your funds. Additionally, domestic foreign exchange regulations may impose standard fees on the transaction. Therefore, initiatives like Project Agorá, which aim to streamline this process, deserve serious attention.

This research project is a collaborative effort between seven central banks and over 40 private-sector firms, aiming to leverage tokenization to streamline wholesale payments. The central banks involved include:

- Bank of France (representing the Eurosystem)

- Bank of Japan

- Bank of Korea

- Bank of Mexico

- Swiss National Bank

- Federal Reserve Bank of New York

- Bank of England

The project also benefits from the support of over 40 private sector companies, including notable firms like Amina Bank, Banco Santander, BBVA, BNP Paribas, Citi, Deutsche Bank AG, HSBC, JPMorgan Chase Bank, Mastercard, and Visa. These companies span commercial banks, payment service providers, and clearinghouses, all of which are contributing to the project’s objectives of enhancing transparency and efficiency in cross-border payment systems.

GOAL, OBJECTIVES AND STRUCTURE

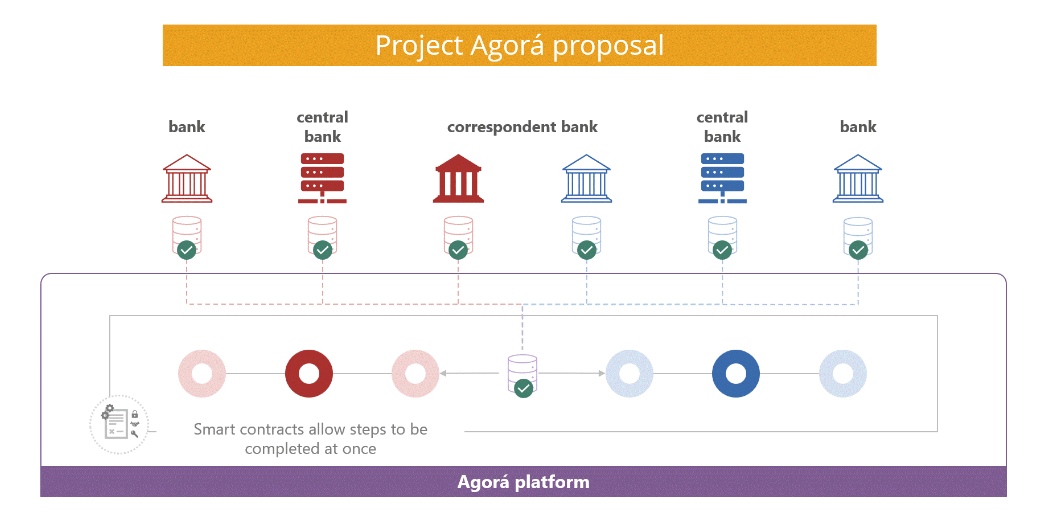

The goal is to transform cross-border payments by developing a multi-currency unified ledger that can simplify and expedite these transactions.

The main objective of Project Agorá is to assess the feasibility of a unified ledger system that can streamline traditional banking processes.

Through tokenization and smart contract technology, the project seeks to reduce transaction times and costs while ensuring greater transparency and compliance with regulatory standards. This endeavor focuses on enhancing existing banking operations with technology to offer faster, more efficient cross-border payments, particularly benefiting jurisdictions with limited correspondent banking options.

Key Objectives:

- Enhancing Efficiency: Show how a unified ledger can optimize business processes in cross-border transactions.

- Tokenization: Explore integrating tokenized commercial and central bank money within a programmable platform.

- Regulatory Compliance: Identify and address legal and regulatory challenges across various jurisdictions involved in tokenized transactions.

Project Agorá goes beyond a simple proof of concept, targeting a prototype that will test a variety of real-world use cases. The project aims to provide a framework for a new type of financial market infrastructure tailored specifically for cross-border payments, although it is important to note that BIS Innovation Hub projects are experimental and results are uncertain.

CHALLENGES AND DISADVANTAGES

While Project Agorá’s focus on cross-border payment innovation is promising, it does come with some challenges:

- Centralized Control: By creating a centralized structure for cross-border payments, the project may clash with the rising preference for decentralized systems that give individuals more financial autonomy, and it may be misused where there are no checks and balances.

- Regulatory Complexity: With multiple central banks involved, navigating diverse regulatory environments could restrict the innovation needed to keep pace with technological advancements.

- Reliance on Traditional Banking: The project’s reliance on existing financial structures could perpetuate some inefficiencies instead of challenging them, potentially limiting opportunities for accessible, low-cost alternatives.

- Technological Risks: As an experimental project, adopting smart contracts and tokenization introduces risks like cybersecurity vulnerabilities, which could impact trust in the system.

- Market Fragmentation: By adding complexity to the financial landscape, the project could inadvertently create barriers for smaller players in cross-border transactions which could increase the population of the unbanked.

FUTURE PROSPECTS

Project Agorá aims to deliver a working prototype by the end of 2025, which will be tested in different scenarios. An upcoming report will outline the prototype’s design, testing methods, and any legal or regulatory challenges it may face, including those related to tokenized commercial and central bank money, settlement processes, and compliance across different regions.

The project’s success will depend on balancing innovation with global accessibility, as well as managing the tension between centralized control and the demand for decentralized solutions.

FINAL THOUGHTS

Project Agorá presents a promising pathway to making cross-border payments more efficient and cost-effective by utilizing advanced technologies like tokenization and smart contracts.

Scheduled for release in 2025, the Project Agorá prototype has the potential to reshape financial infrastructure by serving as a testing ground for a new model in cross-border payments.

If successful, it could enhance efficiency while balancing the benefits of centralized systems with today’s demand for decentralized financial options. However, there’s also a risk that it could inadvertently increase the number of unbanked individuals or become a tool for restrictive control measures.

Sources

Agora Project. (n.d.). The Agora Project: Enabling inclusive digital transformation. Agora Project. Retrieved October 25, 2024, from https://agoraproject.eu/

Bank for International Settlements. (2023). Annual report: Chapter III—Agora Project. Bank for International Settlements. Retrieved October 25, 2024, from https://www.bis.org/publ/arpdf/ar2023e3.htm

Bank for International Settlements. (2024). Agora: Financial market infrastructures. Bank for International Settlements. Retrieved October 25, 2024, from https://www.bis.org/about/bisih/topics/fmis/agora.htm

Bank for International Settlements. (n.d.). Agora FAQ. Bank for International Settlements. Retrieved October 25, 2024, from https://www.bis.org/innovation_hub/projects/agora_faq.pdf

Bank for International Settlements. (n.d.). List of participants: Agora Project. Bank for International Settlements. Retrieved October 25, 2024, from https://www.bis.org/innovation_hub/projects/agora_list_participants.pdf