Effective debtor management is a comprehensive financial strategy employed by businesses to optimize the process of invoicing, credit extension, and timely receipt of payments from customers.

It involves establishing clear and enforceable credit policies, communicating transparently with debtors to encourage timely payments, and maintaining accurate record-keeping systems. The primary goal is to ensure a healthy cash flow by minimizing late payments, reducing bad debt, and mitigating the risks associated with extending credit.

ABOUT DEBTOR MANAGEMENT

Successful debtor management allows businesses, especially small businesses, to navigate financial challenges, meet their own obligations, and foster long-term sustainability by creating a robust foundation for financial stability and growth.

Effective debtor management is crucial for the financial health and sustainability of small businesses. However, many small enterprises face challenges in this area that can impact their cash flow, profitability, and overall success.

In this article, we will explore some common challenges of debtor management for small businesses and try to solve the puzzle called “effective debtor management” by offering some helpful practical solutions and improvements to overcome these obstacles.

LATE PAYMENTS AND CASH FLOW ISSUES

One of the primary challenges small businesses face is dealing with late payments from customers. Late payments can create cash flow problems, making it difficult for businesses to meet their own financial obligations. Inconsistent cash flow can impede growth and lead to missed opportunities.

Solution: Implementing clear and concise payment terms is essential. Clearly communicate expectations to customers and consider offering early payment incentives or implementing late fees to encourage timely payments.

Additionally, leverage technology to streamline invoicing and payment processes, making it easier for customers to fulfill their financial obligations promptly. Popular invoicing and payment processes software solutions such QuickBooks, Square, Invoice Simple, and Stripe are great options but also know that we have local solutions that business owners can use such as AFAS Software Caribbean, Twinfield Caribbean, Sentoo, CX Pay, and Bric Solutions.

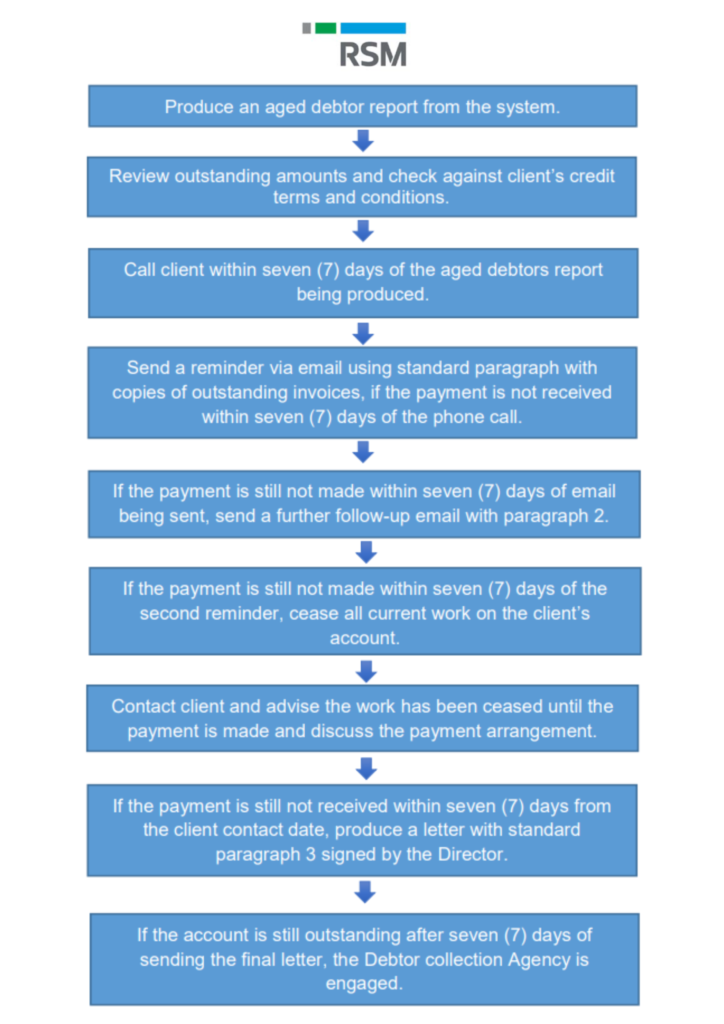

RSM has an interesting simple workflow to handle debtors in their Debtor Management Guide:

LACK OF CREDIT POLICIES

Small businesses often struggle with establishing and enforcing credit policies. Without clear guidelines on credit terms, credit limits, and acceptable payment methods, businesses may find themselves extending credit to unreliable customers, leading to increased bad debt.

Solution: Develop a robust credit policy that outlines credit terms, credit limits, and acceptable payment methods. Consider including payment plans for specific situations. Conduct thorough credit checks on new customers before extending credit. Regularly review and update credit policies based on the business’s financial health and market conditions.

INEFFECTIVE COMMUNICATION

Poor communication with debtors can exacerbate payment delays. Small businesses may hesitate to follow up on overdue payments, fearing damage to customer relationships. However, inadequate communication can result in a vicious cycle of late payments.

Solution: Establish a proactive communication strategy. Send friendly payment reminders before invoices become overdue, and communicate the consequences of late payments. Implementing automated communication systems can help maintain professionalism while ensuring timely and consistent reminders. This can be done on almost all invoicing solutions.

INADEQUATE RECORD-KEEPING

Small businesses may struggle with maintaining accurate and up-to-date records of their accounts receivable. This can lead to confusion, missed payments, and difficulties in identifying trends or recurring issues.

Solution: Invest in accounting software, such as QuickBooks, Twinfield, and many others, that simplifies record-keeping and invoicing processes. Regularly reconcile accounts and conduct thorough reviews of aging reports. Consistent and accurate record-keeping is vital for identifying potential issues early on and implementing corrective measures.

Also, make sure to provide the right information on your documents, and invoice promptly, you are more likely to be paid on time. All quotes, estimates, invoices, contracts, agreements, purchase orders, and related documents should refer to your credit policy.

Invoices should show clearly in accordance with the local legislation (P.B. 2013. No. 53 Article 44 lid 5 & 6) the following information:

- the date on which the invoice was issued;

- the date on which the goods were delivered or the service was provided, if this date differs from the date on which the invoice was issued;

- a sequentially numbered unique invoice number;

- the name or trade name, the billing address, the Crib number, and the registration number assigned by the Curaçao Chamber of Commerce of the business subject to the administration obligation who carries out the delivery of the products or services;

- the name or business name and address of the recipient of the products or services;

- a clear description of the goods or services delivered;

- the quantity of goods delivered and the extent of the services provided;

- the applied Omzetbelasting (Turnover Tax) rate or, if an exemption from turnover tax applies or the turnover tax is levied on the customer this should be mentioned;

- the remuneration and any discounts not included in the unit price;

- the unit price excluding Omzetbelasting (OB) in guilders;

- the amount of OB on the delivered products and services in guilders;

- the total amount to be paid by the customer in guilders or American U.S. dollars if applicable.

In addition to the above mentioned, it is important to mention the payment due date and bank account details of the business subject to the administration obligation who carries out the delivery of the products or services that can help with the debtor management.

FINAL THOUGHTS

Effectively managing debtors is a critical aspect of financial stability for small businesses. By addressing challenges such as late payments, lack of credit policies, ineffective communication, and inadequate record-keeping, businesses can significantly improve their debtor management practices.

Implementing the suggested solutions and improvements will not only enhance cash flow but also contribute to the long-term success and sustainability of small enterprises in an ever-changing business landscape. Additionally supporting our own local invoicing, payment processing, and accounting solutions will have a positive impact on the economy.

Will the puzzle be solved? It’s up to you.

Sources

Government of Curaçao. Publicatie Blad No 53. 2023. LANDSBESLUIT van de 24ste april 2013, no. 13/0990, houdende vaststelling van de tekst van de Algemene landsverordening Landsbelastingen. Artikel 44, Lid 5 & Lid 6.

M. Ayumba and O. Willis. 2021. Debtors Management and Financial Performance of Firms. A Critical Review. IOSR Journal of Economics and Finance (IOSR-JEF) e-ISSN: 2321-5933, p-ISSN: 2321-5925. Volume 12, Issue 6 Ser. II (Nov. – Dec. 2021), PP 45-47.

MGI Australasia. Effective strategies to better debtor management in six simple and easy steps. MGI Worldwide.

RSM Australia. Debtor Management Guide. RSM International.