“The Rise of Financial Technology in Curaçao and Sint Maarten: An Exploratory Analysis”, a report by the Centrale Bank van Curaçao en Sint-Maarten (CBCS) provides an in-depth analysis of the growing financial technology (FinTech) sector in Curaçao and Sint Maarten.

This report is part of CBCS’s efforts to understand and support the development of FinTech as a means to boost economic growth and innovation in the region.

The primary objectives are to map the current landscape of FinTech activities, analyze trends, assess the regulatory environment, and evaluate the potential benefits and risks associated with FinTech development. This article will highlight some key findings and the plans to further develop this industry in Curaçao and Sint Maarten.

But first, for those who don’t know, let’s define financial technology, a.k.a. “Fintech”. We can find several definitions of FinTech on the internet from several institutions. The definition from the Financial Stability Board is an interesting choice if we want to understand the general uses of FinTech:

“FinTech is defined as technology-enabled innovation in financial services that could result in new business models, applications, processes or products with an associated material effect on the provision of services.”

MARKET SEGMENTS´ ACTIVITY AND TRENDS

The rise in FinTech is notably recognized with the rise of information on digital payments, the use of crypto assets, and digital capital raising & lending as stated in the report.

PAYMENTS

There has been significant activity in digital payment solutions, driven by consumer demand for convenience and efficiency. Local businesses are increasingly adopting these technologies to enhance their service offerings.

CRYPTO ASSETS

Interest in cryptocurrencies and blockchain technology, particularly Bitcoin, is rising. Several startups are exploring innovative applications, leveraging Bitcoin and other cryptocurrencies for various financial services.

The introduction of Bitcoin ATMs in Curaçao is one such example, making it easier for individuals to buy and sell Bitcoin locally. Most crypto-asset platforms operate globally, offering their digital services in Curaçao and Sint Maarten as well as other countries that do not have explicit prohibitions.

DIGITAL CAPITAL RAISING AND LENDING

Platforms for peer-to-peer lending and crowdfunding are emerging, providing new avenues for businesses to raise capital outside traditional banking systems.

ONLINE BANKING AND MOBILE BANKING

Traditional banks in Curaçao and Sint Maarten are actively pursuing digital transformation initiatives. Currently, most banks in these regions have implemented online and mobile banking systems, fast payment solutions, and contactless POS systems. Some have already introduced QR codes and scan-to-pay options, while others prioritize these innovations.

This shift underscores the growing importance of digital channels in banking, offering customers greater flexibility and speed in managing their finances across various devices.

THE OTHER TECHs

With the rapid digitization happening globally, numerous technologies have been adapted or newly created to integrate seamlessly with FinTech in the digital landscape. The report highlights two significant innovations: InsurTech and RegTech.

InsurTech refers to the use of technological advancements aimed at achieving cost savings and increased efficiency within the traditional insurance industry model. The term InsurTech is a blend of “insurance” and “technology,” inspired by the term FinTech. It encompasses a range of innovations designed to streamline insurance processes and improve service delivery.

RegTech, on the other hand, involves the use of technology to manage regulatory processes within the financial industry. The primary functions of RegTech include regulatory monitoring, reporting, and ensuring compliance. This technology is essential for helping financial institutions keep up with the ever-evolving regulatory landscape and maintain adherence to legal standards.

GROWTH

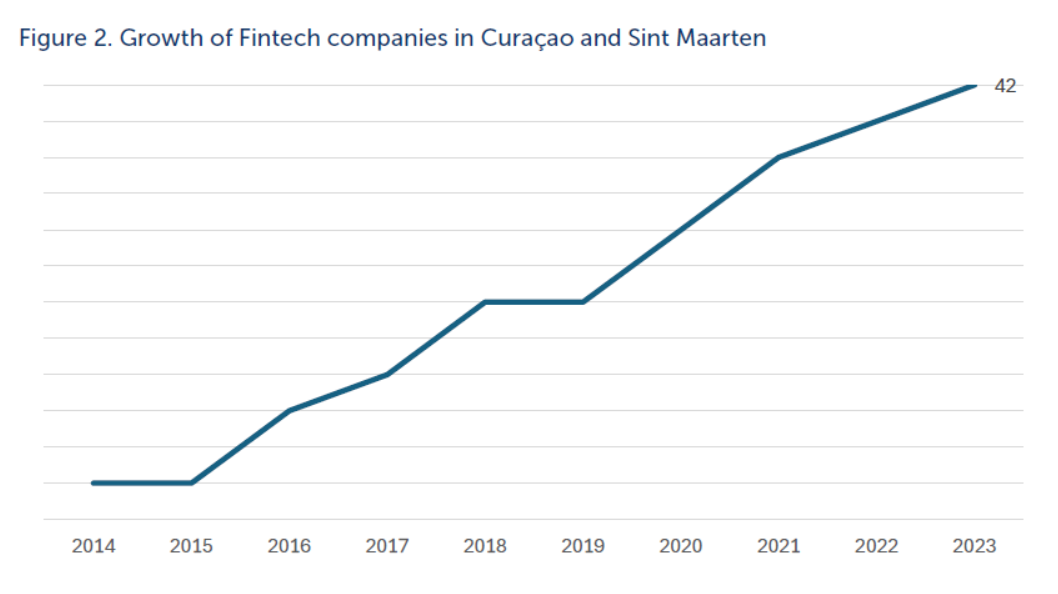

Figure 2 as published in the report illustrates the significant expansion of FinTech firms in Curaçao and Sint Maarten over time, with particularly notable growth during and after the pandemic era.

The Covid pandemic prompted the emergence of numerous new FinTech companies, meeting the rising demand for digital financial services in alignment with global trends. Since 2020, there has been a roughly 50% increase in the number of FinTech companies operating in Curaçao and Sint Maarten.

This growth underscores the rapid adaptation to evolving market dynamics and a transition toward a more digitized financial landscape.

EXPORTING FINTECH

Fintech companies serve financial institutions, businesses, including micro-merchants, who were previously excluded or underserved, as well as government branches. In addition, many of the Fintech companies also extend their services to other areas in the Caribbean region.

Another key component of the success so far is the export of Fintech. Several of the largest Fintech companies provide their services and products beyond the Caribbean and have clients in Latin America and the Netherlands, as can be shown in Figure 3.

REGULATORY FRAMEWORK

The existing regulatory framework is being updated to accommodate the unique needs of FinTech companies. This includes the development of new regulations to ensure financial stability while fostering innovation.

Specific regulations for payments, crypto assets, including Bitcoin, and digital capital raising are in various stages of development, aimed at providing clarity and security for both businesses and consumers.

BENEFITS OF FINTECH

Based on the findings the following benefits related to FinTech were identified:

Economic Growth: FinTech has the potential to drive economic growth by creating new business opportunities and jobs.

Financial Inclusion: Digital financial services can increase access to financial products for underserved populations, enhancing overall financial inclusion.

Efficiency and Innovation: The adoption of FinTech solutions can lead to more efficient financial services, reducing costs and improving customer experiences.

FINTECH: RISKS AND CHALLENGES

The following risks and challenges were identified related to Fintech:

Fraud: This is the risk where the platform uses financial users’ money fraudulently. The most prominent example of fraud on crypto platforms is that of the FTX platform, where money from the users was stolen to artificially increase the value of its balance sheet, which resulted in a collapse and losses of billions of dollars for its users.

Business Continuity: Some platforms have discontinued business without an orderly shutdown process. This can leave users with problems getting their money back.

One such example is Hotbit, a cryptocurrency platform that, after five years, suddenly declared it is no longer operational. Client assets were forcibly changed to stablecoins, and investors could withdraw them from the platform’s wallet. It is not known if Curaçao or Sint Maarten investors were involved.

Cyber-attacks: Cyber-attacks on digital platforms can paralyze businesses and leave customers without alternatives to operate.

Theft: Thefts from crypto asset platforms are also frequent. Globally, USD 3.8 billion was stolen from digital crypto asset platforms in 2022.

Deficient Information to Clients: Many cryptocurrency business platforms do not inform users well about costs, risks, the business model, user rights, etc. This can cause the user to make decisions that turn out to be harmful.

Harmful Products: Many cryptocurrency trading platforms offer ways to leverage invested money, sometimes at elevated levels. These are extremely risky practices.

Digital Dependency and Lack of Claim Points: Another risk of digital crypto business platforms is that many operate completely digitally without a legal and physical presence in the countries where they are active. This makes it difficult or almost impossible to claim damage or harm.

Security and Data Processing: The security and treatment of user data is also a risk of crypto asset business platforms. Due to a lack of standards and supervision, the user cannot be sure that the platform has sufficiently protected data or that it sells or shares it with third parties without the user’s permission.

HIGH RISKS ON CRYPTOCURRENCY PLATFORMS

Particularly interesting are the 4 causes of high risks mentioned in the report related to cryptocurrency platforms identified by the Financial Action Task Force (FATF), the international organization in charge of establishing global standards to prevent and mitigate the risk of illicit transactions:

ENCRYPTION AND ANONYMITY

The encryption of transactions allows anonymity for the user and makes it difficult to control transactions through the platform. Platforms characterized by non-face-to-face customer relationships may allow anonymous funding (cash or third-party funding through virtual exchangers that do not adequately identify the source of funding). They may also allow anonymous transfers if the sender and recipient are not properly identified.

POOR USER IDENTIFICATION

By design, Bitcoin addresses, which function as accounts, do not have names or other client identification, and the system has no central server or service provider. The Bitcoin protocol does not require or provide identification and verification of participants, nor does it generate historical transaction records that are necessarily associated with real-world identity.

COMPLIANCE RESPONSIBILITY

The lack of clarity regarding the responsibility for compliance, monitoring, and enforcement of regulations on illicit transactions is segmented across several countries.

Crypto assets commonly rely on complex infrastructures involving multiple entities, often spread across multiple countries, to transfer funds or execute payments. This segmentation of services means that responsibility for AML/CFT compliance and supervision/enforcement may be unclear.

LACK OF CENTRAL SUPERVISOR

The absence of a central supervisory body further complicates regulation and enforcement efforts.

ARTIFICIAL INTELLIGENCE

Artificial Intelligence (AI) is revolutionizing various industries by enabling machines to perform tasks that typically require human intelligence. From enhancing customer experiences to optimizing operational efficiency, AI applications are becoming integral to business strategies worldwide.

As this technology continues to evolve, it presents both significant opportunities and challenges that organizations must navigate to remain competitive and compliant. The following has been noted on artificial intelligence:

CURRENT USE OF AI

AI is currently being applied by FinTech companies, financial institutions, and regulators worldwide for big data analysis, such as compliance with AML/CFT/CFP and KYC requirements.

AI applications include credit scoring and lending, wealth management, peer-to-peer lending, digital assistants, AML/KYC analysis, fraud detection, algorithmic trading, cryptocurrency transaction monitoring, and insurance underwriting.

LOCAL CONTEXT

To date, local FinTech companies in Curaçao and Sint Maarten have not indicated that AI has been incorporated within their products. However, it is expected that AI will become part of local FinTech offerings in the future.

REGULATORY FRAMEWORK

An AI-specific legislation and audit framework has not yet been developed but is likely to be based on the NIST-AI Risk Management Framework, which aims to prevent harm to individuals, organizations, and existing infrastructures.

INNOVATION AND RISK MANAGEMENT

AI is subject to rapid innovation, and FinTech companies will need to manage third-party software, hardware, and data security risks within their AI supply chain. Adequate risk management steps must be taken when developing or incorporating AI models based on the AI lifecycle. Further research is required to identify and understand the AI use cases that local FinTech companies will develop in response to market demands.

These findings are particularly noteworthy, especially regarding the use of AI and the potential audit requirements associated with its implementation. The interest lies in the fact that many businesses are already incorporating AI into various applications, including widely used platforms such as Microsoft’s Skype, Zoom, and Google Search. These licensed applications seem to have a competitive advantage.

These platforms leverage AI to enhance user experience, improve efficiency, and provide advanced functionalities. Additionally, AI-driven chatbots, once highly popular, continue to play a significant role in customer service and interaction.

The integration of AI in these tools demonstrates its pervasive impact and the growing need for regulatory oversight. As AI technology becomes more embedded in everyday business operations, understanding and addressing the associated audit requirements will be crucial for ensuring compliance and maintaining trust.

NEXT STEPS

Based on the findings of the research, the following recommendations are made to enhance the FinTech ecosystem in Curaçao and Sint Maarten:

Strengthen Data Collection: Improve data collection efforts in Sint Maarten to gain a comprehensive understanding of its FinTech landscape.

Encourage More Collaboration: Foster collaboration between FinTech companies, financial institutions, and regulatory bodies to drive innovation and ensure regulatory compliance.

Encourage Networking: Organize regular networking events, conferences, and workshops to share knowledge and best practices.

Promote Financial Inclusion: Support FinTech solutions that enhance financial inclusion, particularly for underserved populations.

Enhance Regulatory Frameworks: Develop and refine regulatory frameworks that support FinTech innovation while ensuring consumer protection and financial stability.

Consider Sandboxing: Introduce regulatory sandboxes to allow FinTech companies to test new products and services in a controlled environment.

Enhance Cybersecurity Measures: Implement more robust cybersecurity standards and practices to protect FinTech platforms and users from cyber threats.

PREPARING NEW REGULATIONS

The CBCS is committed to accommodating all FinTech activities to achieve their full potential while managing associated risks. The upcoming introduction of the National Ordinance on the Supervision of Payment Service Providers (NOSPSP) and the National Ordinance on the Supervision of Virtual Asset Service Providers (NOSVASP) is fully supported by the CBCS.

In alignment with these National Ordinances, the CBCS is preparing regulations that will guide the orderly introduction of FinTech companies into the regulated financial market.

Additionally, the CBCS recognizes the need to embrace FinTech innovations proactively. An ambitious first step has been created by creating a specific team within the CBCS dedicated to overseeing the FinTech ecosystem and launching an Innovation Office.

LAUNCHING THE INNOVATION OFFICE

The Innovation Office is a contact point for financial innovators to facilitate dialogue, consultation, and interaction between the CBCS and financial innovators. This ensures development in line with the regulatory objectives of the CBCS.

Among others, these objectives include enhancing financial inclusion, promoting the efficient, transparent, and competitive functioning of financial markets, protecting financial consumers, and ensuring financial stability.

FINAL THOUGHTS

The FinTech ecosystem in Curaçao and Sint Maarten is vibrant and increasingly vital to their financial sectors. In Curaçao, 38 FinTech companies drive digital transformation for financial institutions and users, while at least 21 FinTech companies offer products and services from abroad. Although data on Sint Maarten is limited, FinTech is emerging there as well.

Most of the activities of FinTech companies in Curaçao and Sint Maarten are concentrated in the payments segment. FinTech companies offer a varying range of digital payment and electronic money (e-money) services, a digital alternative to cash. Local FinTech companies have a good competitive position with their strong local knowledge, experience, and products and services tailored to meet specific clients’ needs. They have successfully expanded their activities to other markets in the region, underscoring their competitive edge.

However, to sustain growth and establish FinTech as a key economic pillar, investment in current workforce training is imperative. While networking is beneficial, hands-on training by local and international experts is crucial to empower the current local workforce and foster continued innovation in the FinTech landscape. It’s easy to train the young generation and encourage them to choose careers in FinTech but the current local workforce shouldn’t be neglected or replaced with a foreign labor force. Everyone can and should be encouraged to learn more about Fintech.

References

Central Bank of Curaçao and Sint Maarten. (2023). The rise of financial technology in Curaçao and Sint Maarten. Retrieved from https://cdn.centralbank.cw/media/legislation_guidelines/20190120_foreign_exchange_regulation_curacao_and_sint_maarten_2010.pdf

Martina, N., et al. (2021). Fintech: Hype or What? Dutch Caribbean Securities Exchange. Retrieved from https://www.dcsx.cw/fintech-hype-or-what/

Martina, N., et al. (2021). THE ABCDs of FinTech. Dutch Caribbean Securities Exchange. Retrieved from https://www.dcsx.cw/fintech-vs-techfin-whats-the-difference/

Martina, N., et al. (2021). FinTech vs TechFin: What’s the difference? Dutch Caribbean Securities Exchange. Retrieved from https://www.dcsx.cw/fintech-vs-techfin-whats-the-difference/